PSF Increased Deal Flow As Banks Limit Access To Development Capital

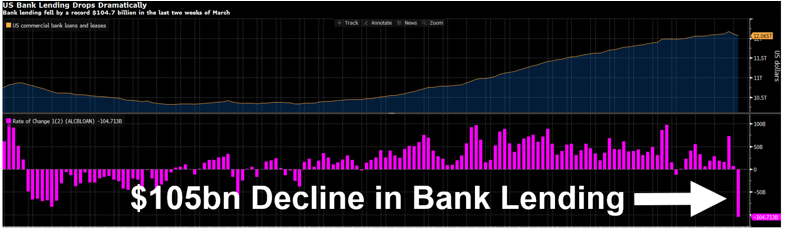

The Fed has made clear its intention to further regulate and constrain regional and community banking lending activity following the abrupt failure of Silicon Valley Bank and elevated financial stress at other institutions. This increased regulatory scrutiny is already leading to a tighter lending environment and decreasing access to development capital.

Banks Tighten Lending Standards: Many banks are facing sizeable unrealized losses in their bond portfolios and additional mark-to-market unrealized losses in their commercial real estate portfolios. The Fed has made its intention clear.

Fewer Net Lease Loan Providers: Traditional financing for build to suit and ground lease projects will become more challenging for developers as a.) construction loans receive poor capital treatment for regulated banks b.) CRE valuations are declining, and c.) banks turn inward to focus on shoring up their balance sheets.

Paramount Specialty Finance is uniquely positioned to fill this void. Our mandate is to invest in net lease development deals with “through-the-cycle” capital, offering a variety of capital stack solutions:

Build to Suit & Ground Lease Loans

80% - 100% Loan to Cost

PSF holds investments on balance sheet

Programmatic documentation and solutions

BTS & GL Joint Venture Equity

PSF brings 90% - 100% of the Project Budget

PSF earns a preferred return on capital invested + Profit Split with Sponsor

Sponsor option to co-invest alongside PSF

We are seeing increased volumes with JV Equity requests as the current rate environment naturally makes this option more attractive

Our team has extensive experience in the net lease space with well over 200 individual transactions and ~$1.3 billion invested. We will remain committed to our borrower and partners throughout this current cycle.

We understand the importance of tailored solutions for your specific project, pipeline of projects, or any net lease deal that’s encountering trouble and in need of capital.

Please reach out to our business development team, so we can help you determine which of our capital solutions is best suited to your pipeline.

Paramount Specialty Finance

Managing Partner